Why Consider a Renovation Loan?

* Investment properties? * Condominiums?

* Vacation properties? *Manufactured homes?

Yes

The Key Advantage?

Loan amounts are based on the home’s after-repair value. That means more buying power, more options, and more control—without waiting years to build equity.

Purchase "cash only" fixers

Stay and repair/remodel with very little equity

Stay and repair/remodel with very little equity

Typical financing requires that a seller fix items before closing. This often results in cash only listings. Rehab financing allows major (and minor) repairs to be done AFTER closing. You can even roll in a few payments while work is in progress.

Stay and repair/remodel with very little equity

Stay and repair/remodel with very little equity

Stay and repair/remodel with very little equity

Like your current location but you're ready for fresh updates and/or need repairs? Let's do it!

HELOCS require 20% equity in most cases. Not everyone has the equity needed to get the projects done.

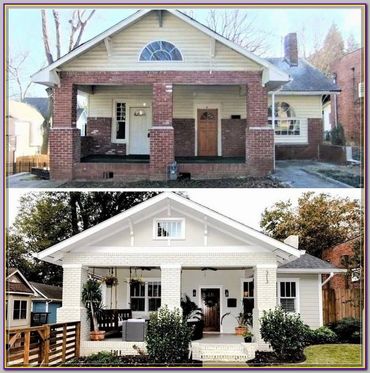

Buy in your price range and make it like new

Stay and repair/remodel with very little equity

Buy in your price range and make it like new

There's nothing good in your price range and you aren't a DIY-er anyway. Buy a cosmetic fixer and hire it done the way you want! New paint, appliances, flooring, lighting, shower... Use your imagination and make it your own.

Zero equity projects for veterans

Investment & vacation property repairs

Buy in your price range and make it like new

Vets - you earned it and it's our turn to serve YOU! VA offers zero down purchase and zero equity refinance for your home repairs.

Build an ADU "mother-in-law" unit

Investment & vacation property repairs

Investment & vacation property repairs

You want one. There's no inventory because everyone else wants one too. Buy any home and have it built! That was easy.

Investment & vacation property repairs

Investment & vacation property repairs

Investment & vacation property repairs

Where is the money coming from for those overdue repairs and appliance upgrades? Some fresh updates could significantly improve your nightly rentals gains!

Download a project budget

idea Gallery

FAQ's

What types of renovation loans are available?

The most common options include:

- FHA 203(k) Standard or Limited

- Fannie Mae HomeStyle® Renovation Loan

- VA Renovation Loan (for eligible veterans)

Each has different eligibility, project types, and cost limits.

What kinds of repairs or improvements are allowed?

Eligible renovations typically include:

- Structural repairs (roof, foundation, plumbing, etc.)

- Cosmetic upgrades (kitchens, bathrooms, flooring, paint)

- Energy efficiency improvements

- Accessibility upgrades

- Additions or complete remodels (with some programs)

Luxury items like pools or outdoor kitchens are available on certain programs.

How much can I borrow?

The loan amount is based on the "after-repair value" (ARV) of the home—not the current condition—allowing you to borrow more than the home is presently worth. Limits depend on the loan program and local conforming loan limits.

Do I need a contractor?

Yes. A licensed and insured contractor must provide a detailed estimate for the repairs. The builder must be licensed, insured and approved with references.

How are the renovation funds disbursed?

Funds for repairs are held in escrow and released in draws as work is completed and inspected. The process is managed to ensure funds are used appropriately and work is completed to standard. An initial deposit to the builder is often allowed to enable them to purchase materials.

How long does the process take?

Expect 45–60 days for closing, due to the additional steps involved (contractor bids, appraisals with repair value, underwriting). Proper planning and documentation can speed things up.

Can I live in the home during renovations?

It depends on the scope of the work. Minor cosmetic updates? Usually yes. Major structural repairs? You may need to move out temporarily, which can often be financed into the loan.

What are the benefits of a renovation loan over using cash or a HELOC?

- One loan, one payment

- Low fixed interest rates compared to credit cards or personal loans

- Leverages future home value to maximize borrowing power

- Avoid draining your savings

Questions? Let's Talk.

Renovation loans are powerful tools, but they’re not one-size-fits-all. Reach out for a clear, no-pressure consultation to explore whether it’s the right fit for your project or purchase.

This website uses cookies.

We use cookies to analyze website traffic and optimize your website experience. By accepting our use of cookies, your data will be aggregated with all other user data.